Real estate tax guides and tips in Japan

If you have an investment property, build or renovate for profit, deal in land, or use a property in running a business, there might be implications for income tax (including capital gains tax), consumption tax, and other related taxes. In recent years, several foreigners have purchased properties in Japan, especially in Niseko or Hakuba, for both private and commercial purposes. They are surprised at the low prices of land and buildings compared to other international ski resorts. Japanese taxation can be difficult to handle especially for foreigners, and the following will further explain the real estate taxation in Japan.

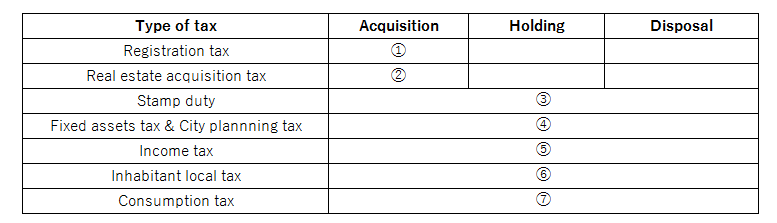

Below is an overview of real estate taxation in Japan based on each phase.

①Registration tax

When certain information is legally registered, it is subject to registration tax, such as registration of a Japanese company, registration of a branch of a foreign company, or registration of a change in the legal ownership of real estate.

“Registration” here refers to the recording of a legal interest in the official real estate registry (toukibo in Japanese) maintained at the local Legal Affairs Bureau.

Registration tax is calculated based on the value of the property, and the registration tax rate varies depending on the type of legal interest being registered.

Example:

Transfer of ownership by sale

・Land:1.5%*

・Building:2%

*Applicable for the period through 31 March 2019. This will be increased to 2% from 1 April 2019 onwards.

Establishment of a Japanese company or a branch

・KK(Kabushiki Kaisha):0.7% of stated capital (minimum JPY150,000)

・GK(Goudou Kaisha):0.7% of stated capital (minimum JPY60,000)

・Branch of a foreign company:JPY90,000

②Real estate acquisition tax

In Japan, real estate acquisition tax is payable by the purchaser every time land/buildings are transferred, regardless of whether or not the transfer is registered in the official real estate registry, and regardless of the amount of the purchase price, construction price, etc. The value of the property is used to calculate the amount of acquisition tax.

The basic tax rate is 4% of the appraised value of the property. Until March 31 2018, land and residential buildings are taxed at a special reduced rate of 3%. In addition to this, there are several tax benefits for real estate acquisition, when certain conditions are met.

You will receive a payment notice of real estate acquisition tax around 6 months after acquisition of properties. Please note that if you are an overseas resident, you are required to appoint a tax agent in Japan to pay tax.

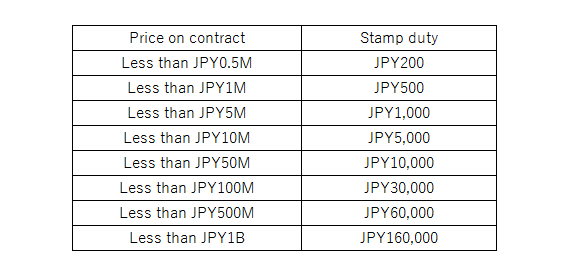

③Stamp duty

Stamp duty is payable on certain real estate documents, such as purchase and sale agreements for land/buildings, agreements to lease land/buildings, and construction contracts, etc. The levy is either based on the value involved or a flat rate.

Example:

The amount of stamp duty for real estate sale contracts (~31 March 2018)

④Fixed assets tax

Fixed assets tax is assessable on both real property and depreciable assets held at 1st January of each year. The tax is levied at 1.4% of the assessed value of real estate and depreciable assets. For lands used for residential purposes, there are certain tax benefits.

In addition, city planning tax is levied at a flat rate of 0.3% on the assessed value of real estate. City planning tax is levied together with the fixed assets tax.

You will receive a payment notice of fixed assets tax every year. Please note that if you are an overseas resident, you are required to appoint a tax agent in Japan to pay tax.

⑤Income tax ⑥Inhabitant local tax

Income tax is payable when you rent out a property even if you are an overseas resident. Also, capital gains are taxable when you sell a property.

Click for more information about income tax.

・Overview of Japanese taxation for individuals

・Guide to income tax refund in Japan

・Japanese tax on rental income

・Capital gains tax on real estate in Japan

⑦Consumption tax

Japanese consumption tax is sales based tax applied on supplies on certain goods and services within Japan, and it is similar to VAT/GST in AUS. The sale or lease of an asset located in Japan is a taxable transaction, however there are some transactions which are specifically excluded from being taxable, such as the sale or lease of land. The current consumption tax rate is 8%, and this will increase to 10% on 1st October 2019.