Capital gains tax on real estate in Japan

When you sell real estate that’s increased in value, you have to pay tax on gains you make on properties in Japan even if you are a non-resident individual or a foreign entity for Japanese tax purposes. Japanese residents are also required to pay taxes on their properties outside of Japan. It means your Japanese residency status determines whether or not you need to pay tax in Japan on your foreign income.

For individual taxpayers, whether you are a Japanese resident usually depends on several factors, such as days spent in Japan, your address, job, situation of your family, nationality, visa status, etc. Your resident status should be determined comprehensively.

In determining the resident status of a company, if the head office of a company is located in Japan, such company is considered as Japanese corporation for tax purposes.

In recent years, several foreigners have purchased properties in Hakuba or Niseko for both private and commercial purposes. They are surprised at the low prices of land and buildings compared to other international ski resorts. The following will further explain the real estate taxation in Japan.

Overview of capital gains tax from the transfer of properties

Capital gains from the transfer of real estate located in Japan are subject to income tax or corporation tax. Withholding tax at 10.21% is generally assessed on the selling amount from the transfer of real estate by a non-resident individual or a foreign corporation. Final settlement of the tax liability on any capital gains incurred will be computed on an individual tax return or a corporation tax return. If the withholding tax amount is greater than the final tax liability, you can claim a tax credit or receive a refund by filing a tax return. K.S. Accounting offers tax preparation services online even for overseas residents. Click here for more information about our taxation services.

It should be noted that if the following conditions are met, there aren’t any payment of withholding tax. However, even if you are a non-resident or a foreign corporation, you are still subject to income tax. In that case, you have to appoint a tax agent in Japan to file a tax return on your behalf to the tax office.

There will be no withholding tax in the following situations:

・The selling price is under JPY100M and

・The buyer is an individual and purchases a property for residential purposes

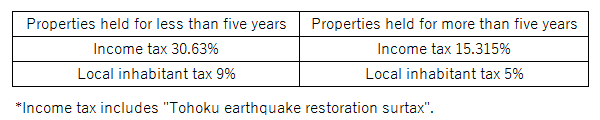

Tax rates on capital gains from the sale of real estate – individual income tax

In Japan, when an individual sells properties, capital gains from assets should be declared in an income tax return. Japanese income tax uses the progressive tax rate for most kinds of income, however, different tax rate is applied for capital gains on properties as follows:

Generally, if you are a non-resident individual, you are not required to pay local inhabitant tax. However, if you have left Japan recently and held residence on January 1 in Japan, you may still be liable for inhabitant tax.

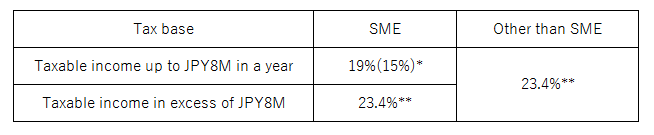

Tax rates on capital gains from the sale of real estate – corporate income tax

The corporation tax is imposed on taxable income of a company at the following tax rates:

*15% is applied to fiscal years beginning prior to 31 March 2017.

**23.9% is applied to fiscal years beginning between 1 April 2015 and 31 March 2016, and 23.2% will be applied to fiscal years beginning after 31 March 2018.

In general, taxable income of corporations is the net of gross revenue less costs, expenses, and losses. A Japanese company is subject to corporate income tax on their worldwide income, however, in order to eliminate double taxation on income, foreign tax credit can be applied.

Capital gains from the transfer of properties in Japan by a foreign company are subject to corporation tax and local corporation tax as well. If income tax are withheld on the proceeds from a transfer of real estate by a foreign company, final settlement of the tax liability should be done on a corporation tax return. The income tax withheld should be creditable against the final tax liability.

How to calculate capital gains for income tax purposes

The taxable gain is computed as follows:

Gross sales price – (acquisition costs + transfer costs)

Acquisition costs include related expenses, such as purchase commission, registration tax, property acquisition tax, etc. Please note that depreciation costs should be deducted from the acquisition costs, so you need to work out to calculate the taxable income.

Please note that if the property under consideration is the taxpayer’s personal residence, JPY30M can be deducted from the capital gain, when certain conditions are met. Also, if the property under consideration is the taxpayer’s personal residence and has been held for more than 10 years, lower tax rate will be applied, when certain conditions are met.

In case of assets other residential properties, such as rental apartments, rental condo, and second home, the special treatments aren’t applied when calculating capital gains.

If your total gains are less than the tax-free allowance

You don’t have to pay tax if total taxable gains are below the tax-free allowance. Whether you are required to file a tax return depends on each taxpayer’s situation, such as taxpayers residency status, kinds of taxable income, kinds of tax allowances applied, etc. If you have any concerns about your tax liability, K.S. Accounting offers e-mail consultation services, so please feel free to contact us.

For example, in case you don’t have any taxable income other than the sales of assets, and you make a loss from the property transfer, you don’t need to file a tax return. However, the tax office may ask you about your taxable income based on the registry information of an asset.

Even if you are not required to file a tax return, you can report losses to reduce your total taxable income. Whether you can reduce your tax burden depends on each taxpayer’s situation, such as residency status, purpose of holding assets, etc. For example, you sell a residential property and still have a mortgage balance, you can use losses to reduce your taxable income or carry forward the remaining losses to a future tax year, when certain requirements are met.

The above is summary for capital gains tax on real estate in Japan, and if you have any questions, please do not hesitate to contact us.