How to claim income tax refund on Lump-sum Withdrawal Payment for foreigners

Persons who do not have Japanese Nationality, when they lose their qualification as an insured person in the National Pension or Employee’s Pension and depart from Japan, can claim a Lump-sum Withdrawal Payment (Social Insurance) within two years from the date they no longer have an address in Japan.

The procedure to claim Lump-sum Withdrawal Payment is not complicated and you can apply yourself if you can prepare the following documents.

Document to be submitted

・Lump-sum Withdrawal Payment Claim Form

・Copy of your passport pages (verifying your name, date of birth, nationality, signature, and status of residence)

・Copy of your passport page (verifying your departure date from Japan)※

・Bank account information for the transfer of the Lump-sum Withdrawal payment

・National Pension Handbook and other documents verifying your Basic Pension Number

※If you submit your claim before your departure, please prepare 1) copy of resident card with registration of Moving-out Notification and the planned deletion date or 2) resident’s card exemption.

Income tax on Lump-sum Withdrawal Payment

For Lump-sum Withdrawal Payment for the National Pension, the income tax is not withheld at source.

However, for the Employees’ Pension, income tax at the rate of 20.42% is withheld at the time of payment. In other words, you will receive only about 80% of the amount of the Lump-Sum Payment.

In order to claim this withholding tax refund, you need to submit the “Tax Return for Refund Due to Taxation on Retirement Income at the Taxpayer’s Option” to the tax office.

By doing so, you will get a tax refund.

As soon as the Lump-sum Withdrawal Payment is remitted, the “Notice of Lump-sum Withdrawal Payment Determination” is sent to your home country.

Please send the original “Notice” to your Tax Agent. If your Tax Agent is a tax accountant, you can ask him or her to file your tax return and claim your refund immediately.

Guide to income tax refund in Japan

You might think that claiming an income tax refund in Japan can be confusing and complicated. Filing a tax return isn’t easy, and especially doing it in another country can be particularly challenging. K.S. Accounting has the expertise and vast experience in the international tax field in Japan, and we have the right people to handle your income tax needs. You can still claim your tax refund up to five years. Click here for more information about our taxation services.

Income tax refund for employees

If you work for a Japanese company and that’s your sole source of income in Japan, your company will take care of every tax matters for you. However, it would be advisable to file a tax return in a certain situation, as you can get a tax refund when certain conditions are met. For example, you can claim a tax refund in the following:

・If you left a company and your company didn’t carry out a year-end adjustment procedure for you, you may get a tax refund.

・If you have a large amount of medical expenses, you can apply for medical expenses deduction on your income tax return.

・Income tax on lump-sum withdrawal payments*

・If you buy or build your own home in Japan and has an outstanding loan balance, you can apply for special tax credit about the housing loan.**

*Certain persons who enrolled in Japanese public pension schemes for 6 months or longer can apply for lump-sum withdrawal payments to the Japan Pension Service after they leave Japan. When you receive the payments, income tax at a rate of 20.42% on the amount to be paid is withheld from the payment. In this case, you may claim a tax refund if you opt to file a tax return.

**There are a bunch of rules associated with this system. For example, the tax credit is only available for personal residences and cannot be applied for holiday homes, second homes or rental properties. The tax office will require a proof of residence. Your personal annual income must not exceed JPY30M, and the tax credit is only available for a period of 10 years from purchase. Please note that non-residents (those who are living overseas and who do not have residence in Japan) are eligible for purchase after April 2016.

Income tax refund for non-resident property owners

If the tenant of your property is a company (e.g. a company renting the apartment for their employees), the tenant must withhold 20.42% of the monthly rent. If the withholding tax paid is higher than your income tax payable, the excess can be refunded.

You must pay income tax on the profit you make from renting out the property, after deductions for “allowable expenses”. Allowable expenses are things you need to spend money on the day-to-day running of the property. If your property business is in deficit, you don’t need to pay tax and you can claim a tax refund. (Maintenance costs or depreciation expenses tend to be large for property business, and income tax can be often refunded.)

In that case, you will need to appoint a tax agent in Japan to file a tax return on your behalf to the tax office. We’d be glad to offer tax preparation services online even for overseas residents. If you have any concerns about Japanese taxation, please feel free to contact us.

Capital gains tax on real estate in Japan

When you sell real estate that’s increased in value, you have to pay tax on gains you make on properties in Japan even if you are a non-resident individual or a foreign entity for Japanese tax purposes. Japanese residents are also required to pay taxes on their properties outside of Japan. It means your Japanese residency status determines whether or not you need to pay tax in Japan on your foreign income.

For individual taxpayers, whether you are a Japanese resident usually depends on several factors, such as days spent in Japan, your address, job, situation of your family, nationality, visa status, etc. Your resident status should be determined comprehensively.

In determining the resident status of a company, if the head office of a company is located in Japan, such company is considered as Japanese corporation for tax purposes.

In recent years, several foreigners have purchased properties in Hakuba or Niseko for both private and commercial purposes. They are surprised at the low prices of land and buildings compared to other international ski resorts. The following will further explain the real estate taxation in Japan.

Overview of capital gains tax from the transfer of properties

Capital gains from the transfer of real estate located in Japan are subject to income tax or corporation tax. Withholding tax at 10.21% is generally assessed on the selling amount from the transfer of real estate by a non-resident individual or a foreign corporation. Final settlement of the tax liability on any capital gains incurred will be computed on an individual tax return or a corporation tax return. If the withholding tax amount is greater than the final tax liability, you can claim a tax credit or receive a refund by filing a tax return. K.S. Accounting offers tax preparation services online even for overseas residents. Click here for more information about our taxation services.

It should be noted that if the following conditions are met, there aren’t any payment of withholding tax. However, even if you are a non-resident or a foreign corporation, you are still subject to income tax. In that case, you have to appoint a tax agent in Japan to file a tax return on your behalf to the tax office.

There will be no withholding tax in the following situations:

・The selling price is under JPY100M and

・The buyer is an individual and purchases a property for residential purposes

Tax rates on capital gains from the sale of real estate – individual income tax

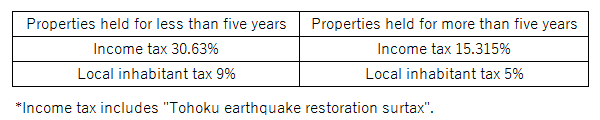

In Japan, when an individual sells properties, capital gains from assets should be declared in an income tax return. Japanese income tax uses the progressive tax rate for most kinds of income, however, different tax rate is applied for capital gains on properties as follows:

Generally, if you are a non-resident individual, you are not required to pay local inhabitant tax. However, if you have left Japan recently and held residence on January 1 in Japan, you may still be liable for inhabitant tax.

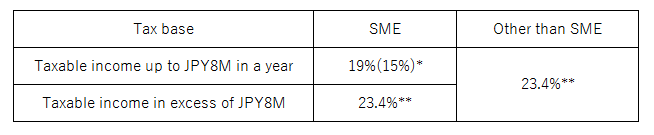

Tax rates on capital gains from the sale of real estate – corporate income tax

The corporation tax is imposed on taxable income of a company at the following tax rates:

*15% is applied to fiscal years beginning prior to 31 March 2017.

**23.9% is applied to fiscal years beginning between 1 April 2015 and 31 March 2016, and 23.2% will be applied to fiscal years beginning after 31 March 2018.

In general, taxable income of corporations is the net of gross revenue less costs, expenses, and losses. A Japanese company is subject to corporate income tax on their worldwide income, however, in order to eliminate double taxation on income, foreign tax credit can be applied.

Capital gains from the transfer of properties in Japan by a foreign company are subject to corporation tax and local corporation tax as well. If income tax are withheld on the proceeds from a transfer of real estate by a foreign company, final settlement of the tax liability should be done on a corporation tax return. The income tax withheld should be creditable against the final tax liability.

How to calculate capital gains for income tax purposes

The taxable gain is computed as follows:

Gross sales price – (acquisition costs + transfer costs)

Acquisition costs include related expenses, such as purchase commission, registration tax, property acquisition tax, etc. Please note that depreciation costs should be deducted from the acquisition costs, so you need to work out to calculate the taxable income.

Please note that if the property under consideration is the taxpayer’s personal residence, JPY30M can be deducted from the capital gain, when certain conditions are met. Also, if the property under consideration is the taxpayer’s personal residence and has been held for more than 10 years, lower tax rate will be applied, when certain conditions are met.

In case of assets other residential properties, such as rental apartments, rental condo, and second home, the special treatments aren’t applied when calculating capital gains.

If your total gains are less than the tax-free allowance

You don’t have to pay tax if total taxable gains are below the tax-free allowance. Whether you are required to file a tax return depends on each taxpayer’s situation, such as taxpayers residency status, kinds of taxable income, kinds of tax allowances applied, etc. If you have any concerns about your tax liability, K.S. Accounting offers e-mail consultation services, so please feel free to contact us.

For example, in case you don’t have any taxable income other than the sales of assets, and you make a loss from the property transfer, you don’t need to file a tax return. However, the tax office may ask you about your taxable income based on the registry information of an asset.

Even if you are not required to file a tax return, you can report losses to reduce your total taxable income. Whether you can reduce your tax burden depends on each taxpayer’s situation, such as residency status, purpose of holding assets, etc. For example, you sell a residential property and still have a mortgage balance, you can use losses to reduce your taxable income or carry forward the remaining losses to a future tax year, when certain requirements are met.

The above is summary for capital gains tax on real estate in Japan, and if you have any questions, please do not hesitate to contact us.

Japanese tax on rental income – about withholding tax and tax returns

Recently, the number of investors who purchase properties in Japan is rapidly increasing, since Tokyo will host the Olympic Games in 2020 and investors have a high expectation for it. Also, the number of foreign visitors are sharply increasing and they enjoy the Japanese culture during their stay. Some foreign visitors go to ski resorts like Niseko and Hakuba, which are renowned for its consistency and quality of powder snow throughout the winter, and investors regard such resort areas as invest opportunities as well. In this article, we will explain Japanese taxation related to investments to properties.

What is your taxpayer status in Japan?

Your Japanese resident status affects whether or not you need to pay tax in Japan on your foreign income. Non-residents only pay tax on their Japanese income – they don’t pay Japanese tax on their foreign income. Residents normally pay Japanese tax on all their worldwide income, so it is whether it’s from Japan or abroad.

Whether you are Japanese resident usually depends on several factors, such as how many days you spend in Japan, your address, your job, situation of your family, nationality, visa status, etc. Your resident status should be determined comprehensively. Click here for more information of taxpayer status.

Purchasing real estate in Japan

There is an increasing number of foreigners purchasing real estate here in Hakuba, Japan, ever since Hakuba became well-known for one of the greatest ski resorts in Asia. In the past, the most common investments are from Australia, but nowadays investments coming from Asia, such as China, Taiwan, Singapore are rapidly increasing. Some of them acquire a property for investment purposes and such non-resident owners consider leasing their properties.

Needless to say, non-Japanese living in Japan look for Hakuba/Niseko as investment opportunities, or purchase properties as their second home. Such Japanese resident owners may consider leasing their properties during their absence as well.

How to calculate profits on rental income

You may have to pay Japanese income tax even if your taxpayer status is non-resident, in case you rent out a property and your gains are above the tax-free allowance. Please be aware that for properties owned by a company, rental income should be treated as the same way as any other income from its business.

Rental income includes:

・Rent

・Key money

・Contract renewal fees

You must pay income tax on the profit you make from renting out the property, after deductions for “allowable expenses”. Allowable expenses are things you need to spend money on the day-to-day running of the property.

Costs you can claim to reduce tax:

・letting agents’ fees

・legal fees

・accountants’ fees

・buildings and contents insurance

・maintenance and repairs to the property (but not improvements)

・utility bills, like gas, water and electricity

・property tax

・services you pay for, like cleaning or gardening

・other direct costs of letting the property, like phone calls, stationery and advertising

Allowable expenses don’t include “capital expenditure” – like renovating it beyond repairs. Such costs should be depreciated over useful lives as fixed assets, and the depreciation costs will be treated as deductible expenses each year.

Withholding tax and tax returns for non-resident owners

If the tenant of your property is a company (e.g. a company renting the apartment for their employee), the tenant must withhold 20.42% of the monthly rent and pay it to the tax office by the 10th day of the following month. If the withholding tax paid is higher than the amount liable, the excess can be refunded. It means that if your property business is in deficit, you don’t need to pay tax and you can claim a tax refund. (Maintenance costs or depreciation expenses tend to be large for property business, and income tax can be often refunded.)

In that case, you will need to appoint a tax agent in Japan to file a tax return on your behalf to the tax office. We offer these services online, so even if you are an overseas resident, we can provide tax preparation services. Click here for more information about our taxation services. Please note that even if you cannot receive a refund, you have to file tax returns to the tax office, when taxable gains are above the tax-free allowance.

If an individual leases your property for residential purposes, he/she is not required to withhold any rent. However, even if your taxpayer status is non-resident and there’s no withholding tax, you are still subject to aggregate taxation and need to pay tax, when taxable gains are above the tax-free allowance. In that case, you will need to appoint a tax agent in Japan to file a tax return on your behalf to the tax office each year.