How to claim income tax refund on Lump-sum Withdrawal Payment for foreigners

Persons who do not have Japanese Nationality, when they lose their qualification as an insured person in the National Pension or Employee’s Pension and depart from Japan, can claim a Lump-sum Withdrawal Payment (Social Insurance) within two years from the date they no longer have an address in Japan.

The procedure to claim Lump-sum Withdrawal Payment is not complicated and you can apply yourself if you can prepare the following documents.

Document to be submitted

・Lump-sum Withdrawal Payment Claim Form

・Copy of your passport pages (verifying your name, date of birth, nationality, signature, and status of residence)

・Copy of your passport page (verifying your departure date from Japan)※

・Bank account information for the transfer of the Lump-sum Withdrawal payment

・National Pension Handbook and other documents verifying your Basic Pension Number

※If you submit your claim before your departure, please prepare 1) copy of resident card with registration of Moving-out Notification and the planned deletion date or 2) resident’s card exemption.

Income tax on Lump-sum Withdrawal Payment

For Lump-sum Withdrawal Payment for the National Pension, the income tax is not withheld at source.

However, for the Employees’ Pension, income tax at the rate of 20.42% is withheld at the time of payment. In other words, you will receive only about 80% of the amount of the Lump-Sum Payment.

In order to claim this withholding tax refund, you need to submit the “Tax Return for Refund Due to Taxation on Retirement Income at the Taxpayer’s Option” to the tax office.

By doing so, you will get a tax refund.

As soon as the Lump-sum Withdrawal Payment is remitted, the “Notice of Lump-sum Withdrawal Payment Determination” is sent to your home country.

Please send the original “Notice” to your Tax Agent. If your Tax Agent is a tax accountant, you can ask him or her to file your tax return and claim your refund immediately.

Real estate tax guides and tips in Japan

If you have an investment property, build or renovate for profit, deal in land, or use a property in running a business, there might be implications for income tax (including capital gains tax), consumption tax, and other related taxes. In recent years, several foreigners have purchased properties in Japan, especially in Niseko or Hakuba, for both private and commercial purposes. They are surprised at the low prices of land and buildings compared to other international ski resorts. Japanese taxation can be difficult to handle especially for foreigners, and the following will further explain the real estate taxation in Japan.

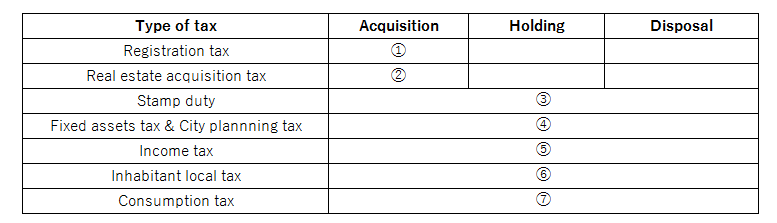

Below is an overview of real estate taxation in Japan based on each phase.

①Registration tax

When certain information is legally registered, it is subject to registration tax, such as registration of a Japanese company, registration of a branch of a foreign company, or registration of a change in the legal ownership of real estate.

“Registration” here refers to the recording of a legal interest in the official real estate registry (toukibo in Japanese) maintained at the local Legal Affairs Bureau.

Registration tax is calculated based on the value of the property, and the registration tax rate varies depending on the type of legal interest being registered.

Example:

Transfer of ownership by sale

・Land:1.5%*

・Building:2%

*Applicable for the period through 31 March 2019. This will be increased to 2% from 1 April 2019 onwards.

Establishment of a Japanese company or a branch

・KK(Kabushiki Kaisha):0.7% of stated capital (minimum JPY150,000)

・GK(Goudou Kaisha):0.7% of stated capital (minimum JPY60,000)

・Branch of a foreign company:JPY90,000

②Real estate acquisition tax

In Japan, real estate acquisition tax is payable by the purchaser every time land/buildings are transferred, regardless of whether or not the transfer is registered in the official real estate registry, and regardless of the amount of the purchase price, construction price, etc. The value of the property is used to calculate the amount of acquisition tax.

The basic tax rate is 4% of the appraised value of the property. Until March 31 2018, land and residential buildings are taxed at a special reduced rate of 3%. In addition to this, there are several tax benefits for real estate acquisition, when certain conditions are met.

You will receive a payment notice of real estate acquisition tax around 6 months after acquisition of properties. Please note that if you are an overseas resident, you are required to appoint a tax agent in Japan to pay tax.

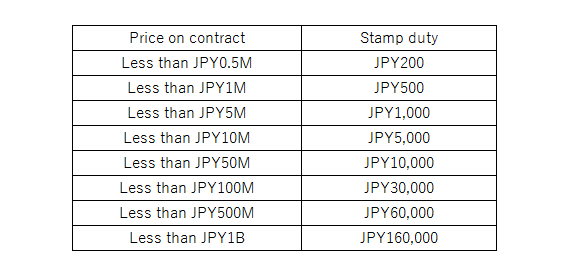

③Stamp duty

Stamp duty is payable on certain real estate documents, such as purchase and sale agreements for land/buildings, agreements to lease land/buildings, and construction contracts, etc. The levy is either based on the value involved or a flat rate.

Example:

The amount of stamp duty for real estate sale contracts (~31 March 2018)

④Fixed assets tax

Fixed assets tax is assessable on both real property and depreciable assets held at 1st January of each year. The tax is levied at 1.4% of the assessed value of real estate and depreciable assets. For lands used for residential purposes, there are certain tax benefits.

In addition, city planning tax is levied at a flat rate of 0.3% on the assessed value of real estate. City planning tax is levied together with the fixed assets tax.

You will receive a payment notice of fixed assets tax every year. Please note that if you are an overseas resident, you are required to appoint a tax agent in Japan to pay tax.

⑤Income tax ⑥Inhabitant local tax

Income tax is payable when you rent out a property even if you are an overseas resident. Also, capital gains are taxable when you sell a property.

Click for more information about income tax.

・Overview of Japanese taxation for individuals

・Guide to income tax refund in Japan

・Japanese tax on rental income

・Capital gains tax on real estate in Japan

⑦Consumption tax

Japanese consumption tax is sales based tax applied on supplies on certain goods and services within Japan, and it is similar to VAT/GST in AUS. The sale or lease of an asset located in Japan is a taxable transaction, however there are some transactions which are specifically excluded from being taxable, such as the sale or lease of land. The current consumption tax rate is 8%, and this will increase to 10% on 1st October 2019.

Japanese tax on rental income – about withholding tax and tax returns

Recently, the number of investors who purchase properties in Japan is rapidly increasing, since Tokyo will host the Olympic Games in 2020 and investors have a high expectation for it. Also, the number of foreign visitors are sharply increasing and they enjoy the Japanese culture during their stay. Some foreign visitors go to ski resorts like Niseko and Hakuba, which are renowned for its consistency and quality of powder snow throughout the winter, and investors regard such resort areas as invest opportunities as well. In this article, we will explain Japanese taxation related to investments to properties.

What is your taxpayer status in Japan?

Your Japanese resident status affects whether or not you need to pay tax in Japan on your foreign income. Non-residents only pay tax on their Japanese income – they don’t pay Japanese tax on their foreign income. Residents normally pay Japanese tax on all their worldwide income, so it is whether it’s from Japan or abroad.

Whether you are Japanese resident usually depends on several factors, such as how many days you spend in Japan, your address, your job, situation of your family, nationality, visa status, etc. Your resident status should be determined comprehensively. Click here for more information of taxpayer status.

Purchasing real estate in Japan

There is an increasing number of foreigners purchasing real estate here in Hakuba, Japan, ever since Hakuba became well-known for one of the greatest ski resorts in Asia. In the past, the most common investments are from Australia, but nowadays investments coming from Asia, such as China, Taiwan, Singapore are rapidly increasing. Some of them acquire a property for investment purposes and such non-resident owners consider leasing their properties.

Needless to say, non-Japanese living in Japan look for Hakuba/Niseko as investment opportunities, or purchase properties as their second home. Such Japanese resident owners may consider leasing their properties during their absence as well.

How to calculate profits on rental income

You may have to pay Japanese income tax even if your taxpayer status is non-resident, in case you rent out a property and your gains are above the tax-free allowance. Please be aware that for properties owned by a company, rental income should be treated as the same way as any other income from its business.

Rental income includes:

・Rent

・Key money

・Contract renewal fees

You must pay income tax on the profit you make from renting out the property, after deductions for “allowable expenses”. Allowable expenses are things you need to spend money on the day-to-day running of the property.

Costs you can claim to reduce tax:

・letting agents’ fees

・legal fees

・accountants’ fees

・buildings and contents insurance

・maintenance and repairs to the property (but not improvements)

・utility bills, like gas, water and electricity

・property tax

・services you pay for, like cleaning or gardening

・other direct costs of letting the property, like phone calls, stationery and advertising

Allowable expenses don’t include “capital expenditure” – like renovating it beyond repairs. Such costs should be depreciated over useful lives as fixed assets, and the depreciation costs will be treated as deductible expenses each year.

Withholding tax and tax returns for non-resident owners

If the tenant of your property is a company (e.g. a company renting the apartment for their employee), the tenant must withhold 20.42% of the monthly rent and pay it to the tax office by the 10th day of the following month. If the withholding tax paid is higher than the amount liable, the excess can be refunded. It means that if your property business is in deficit, you don’t need to pay tax and you can claim a tax refund. (Maintenance costs or depreciation expenses tend to be large for property business, and income tax can be often refunded.)

In that case, you will need to appoint a tax agent in Japan to file a tax return on your behalf to the tax office. We offer these services online, so even if you are an overseas resident, we can provide tax preparation services. Click here for more information about our taxation services. Please note that even if you cannot receive a refund, you have to file tax returns to the tax office, when taxable gains are above the tax-free allowance.

If an individual leases your property for residential purposes, he/she is not required to withhold any rent. However, even if your taxpayer status is non-resident and there’s no withholding tax, you are still subject to aggregate taxation and need to pay tax, when taxable gains are above the tax-free allowance. In that case, you will need to appoint a tax agent in Japan to file a tax return on your behalf to the tax office each year.

Overview of Japanese taxation for individuals

Individual income tax in Japan consists of national income tax and local inhabitant tax. The taxable year of individual income tax is the calendar year, while local inhabitant tax is assessed on individuals who live in Japan as of 1 January. Inhabitant tax is calculated based on income for the preceding year.

Individuals who sell and acquire goods and services in Japan will suffer consumption tax on those transactions. In principle, consumption taxpayer status is determined depending on the amount of domestic taxable sales in the past. Japanese consumption tax is sales based tax and is similar to VAT/GST.

Classification of individual taxpayers

There are two categories of individual taxpayers – Resident or non-resident. Below is the definition.

Resident:

Residents are divided to either permanent resident or non-permanent resident.

A non-permanent resident is an individual who doesn’t have Japanese nationality and has lived in Japan for 5 years or less in the last 10 years.

A permanent resident is an individual other than a non-permanent resident, i.e. an individual who has Japanese nationality, or has lived in Japan for more than 5 years in the last 10 years. Permanent resident is subject to Japanese income taxes on worldwide income.

Non-resident:

A non-resident is an individual other than a resident. Basically, an individual who does not have an address in Japan and has lived in Japan for less than 1 year.

Short term visitors

Generally, Japan’s double tax treaties are in line with OECD model treaty regarding the treatment of tax exempt foreign employees temporally working in Japan. Such employees are generally tax-exempt if they meet the following 3 criteria:

・They are present in Japan for less than 183 days in any 12 month period

・Their salary is paid by a non-resident employer

・There aren’t any salary paid by a permanent establishment (PE) in Japan

This criteria depends on each country’s tax treaty, so please refer to the double tax treaty of your country.

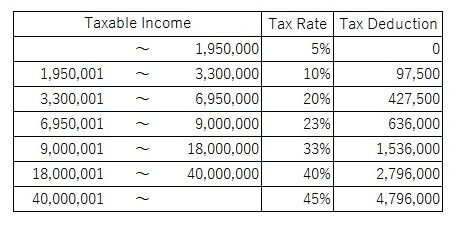

Tax rate

Japanese income tax use the progressive tax rate. The following rates are applied to the income (revenue-expenses) minus allowable tax deductions. (2015~)

National income tax rate

Example

If your taxable income is JPY7,000,000, income tax amount is following:

7,000,000×0.23-636,000=974,000

Local tax rate

Local tax consists of two categories – per capita levy and income-based levy. Per capita tax is around JPY5,000/year depending on each municipal government. Inhabitant tax rate is 10%, regardless of the amount of taxable income. A non-resident is generally not liable for inhabitant tax, however if a non-resident is registered in the municipal government and lives in Japan as of 1 January, the individual may be liable for inhabitant tax.

Generally, inhabitant tax returns are not required to be filed since the information necessary for assessment is submitted by your employer or by filing income tax returns.